Pink diamond investing as part of a portfolio? If this idea raises an eyebrow, it’s quite possibly because as progressive the investment market might claim to be, there’s an awful lot about it that’s very much bound by tradition.

‘Traditional investments’ are those that we can all recite with barely a thought….stocks, bonds, commodities. And while these evergreens might still be where a lot of the action lies, a handy reminder of an alternative investment might in fact be on your finger right now. Yes, diamonds. But not just any diamonds. Increasingly, Pink Diamonds are emerging as a prized, high-performance investment. ‘Hard assets’ have special benefits as investments, and pink diamonds are hard assets with many special unique advantages.

Under the radar – for millions of years

Pink diamond investing is perhaps one of those ideas that’s been hiding in plain sight. Diamonds are very much part of western luxury culture, yet we’re used to associating them more with romance and jewellery than investing. Pink diamonds are nowhere near as common as the white or colourless diamonds that tend to grab the spotlight, and there’s your first clue as to how they qualify as an investment. You see, ‘nowhere near as common’ as white diamonds is something of an understatement. In fact with the closing of Western Australia’s Argyle pink diamond mine in 2020, pink diamonds have become a strictly finite rarity. Millenia in the making, it’s perhaps surprising that pink diamond investing has only recently gained attention as an ‘emerging’ or ‘alternative’ investment.

Alternative, but not as we know it – hard assets that shine

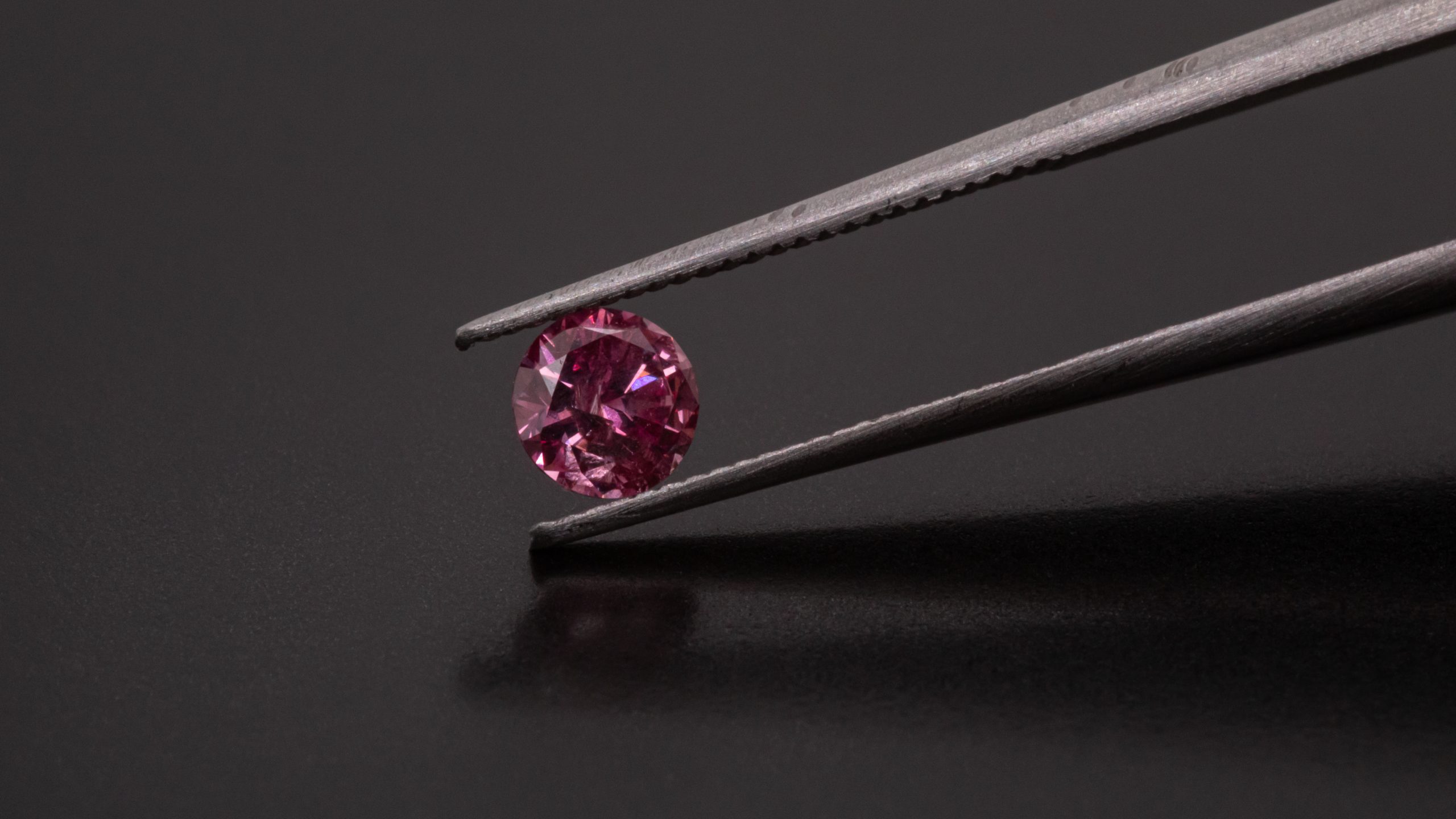

Outside of traditional investments there are some well-known options including hedge funds, private equity, real estate and gold. More recently, alternatives including cryptocurrencies have raised some eyebrows and brought with them something of a high-risk air. Who hasn’t heard a story or two of volatility and fraud involving crypto, after all? Pink diamond investing is the very antithesis of these digital alternatives. Among the virtues of pink diamonds is the simple fact that they are ‘real’; solid and tangible. Utterly unchanging, each one absolutely unique, able to be identified, its provenance and history traced. Pink diamond investing is literally ‘rock solid’, grounded in tangible assets

Scarce, stable, tradeable

As discussed earlier, pink diamond investing today is based on a finite supply. Western Australia’s Argyle mine – the world’s only source of investment grade pink diamonds – ceased operation in 2020, meaning that the market is working with all the Argyle investment grade pink diamonds that will ever be. Pink diamonds have outperformed virtually all comers through thick and thin over the past 20 years, and there’s every reason to believe that this trend will continue now that Argyle supply has stopped.

Unlike other tangibles such as gold, every pink diamond is unique. So pink diamond investing focusing on Argyle investment grade pink diamonds deals with individual stones, each with a clearly traceable history and story, all the way back to the mine. If tracing this history sounds like the realm of experts, it very much is.

“Pink diamond investing starts with a trained Gemmologist”, says Pink Diamond Capital’s CEO Eric Kariuki. “Of course knowing what you’re looking at is just the start. In such a highly specialised field, connections also count for a lot. Individuals with a working knowledge of the pink diamond market as well as access to information regarding which gems are being bought and sold, and by who, are almost as rare as the pink diamonds themselves!” As it happens, Mr Kariuki is just such a man – qualified, connected and experienced.

“Pink diamonds as an investment have many benefits beyond proven performance”, says Mr Kariuki. “They represent concentrated wealth. They are small, very traceable, quite portable, and straightforward to both securely store and trade. Investments can be volatile, but pink diamonds are amongst the most stable. For an investor who favours ‘hard assets’ in their portfolio, pink diamond investing makes a lot of sense. And of course for those simply seeking to diversify, they are equally attractive.”

If you are considering pink diamonds as part of your portfolio, Pink Diamond Capital hosts regular free educational events for investors. To register for such an event or simply to make an appointment to speak with Pink Diamond Capital Director Eric Kariuki about your needs, simply click here.